Swiggy Limited IPO Details:

IPO Date: 6th to 8th November, 2024

Total Issue Size: ~29 Cr shares

Fresh Issue: ~ Rs. 4,499 Crores

Offer for Sale: ~ Rs. 6,828.43 Crores

Price Band: Rs. 371 – Rs. 390 per share

IPO Issue Size: ~ Rs. 11,327.43 Crores

Lot Size: 38 shares and multiples thereof

Swiggy has become a household name in India, fundamentally reshaping consumer preferences toward online food delivery. With their innovative approaches and extensive service offerings, these companies have played a pivotal role in making food delivery an integral part of daily life for millions of Indians. As Swiggy prepares for its upcoming IPO, it stands at the forefront, ready to capitalize on its significant market presence and growing consumer demand.

The company recently filed its RHP, aiming to raise approximately Rs.4,499 Cr through fresh share issuance, alongside an offer for sale of shares worth Rs. 6,828 Cr from existing investors. This IPO is expected to be one of the largest public offerings in India this year after Hyundai. Swiggy plans to utilize the proceeds to expand its quick commerce segment, enhance technology infrastructure, and bolster brand marketing efforts as it navigates a competitive landscape dominated by rivals like Zomato & Zepto.

Let’s get an understanding of the Food Delivery and Quick Commerce industry first and then we’ll understand how Swiggy is trying to grow in the same.

Company Overview:

Swiggy is a hyperlocal commerce player in India. It launched its Food Delivery service in 2014 and quick commerce in 2020. Swiggy is recognized as a leader in innovation in hyperlocal commerce and is synonymous with the categories it serves. It is the only unified app in India that fulfills all food and related needs of urban users, including ordering in, eating out, and cooking at home.

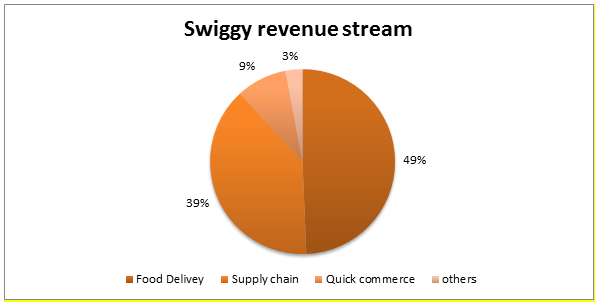

In FY24 Swiggy’s adjusted revenue (includes delivery charges received from customers) stood at Rs. 12,203 Cr. Online food delivery contributed 49% to the adj. revenue followed by the supply chain segment contributing 39% to the adj. revenue. Although the quick commerce segment contributes only 9% to the revenue it has an immense potential to grow as the market is still underpenetrated.

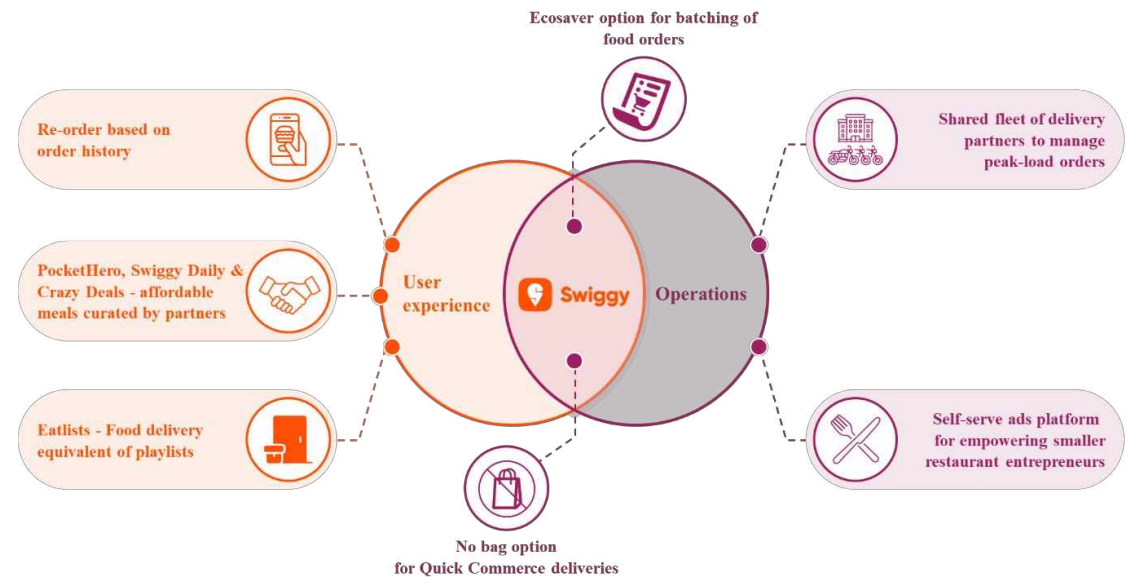

The company actively focuses on addressing gaps in the convenience needs of users by adding new offerings or supplementing existing services in its ecosystem, and spurring innovations across its value chain provides them with an edge and sustainability of its business.

The company leverages its network of users and partners to assess the market attractiveness and demand for new offerings through targeted tests. Once a service is proven viable for achieving scale, profitable unit economics and geographic reach through these tests, the company starts scaling offerings across cities.

Industry Overview:

India is a densely populated country, with ~480 people per square kilometer as of 2023. This is 13 times and 3 times the population density of the USA and China, respectively. Migration to urban cities has further increased the population density. Denser cities and busy lifestyles have led to a greater reliance on convenience providers, particularly in urban areas where income levels are higher. The crowded city centers, high traffic, and long waiting times have influenced people's decisions about going out, leading to an increasing preference for hyperlocal deliveries as a way to save time and money. The following factors are contributing to the industry's growth.

Demographics:

According to Redseer, the increase in the number of middle-class households (including upper and lower-middle-class households) is projected to grow from ~143 million in 2018 to ~173 million in 2023. This growth is attributed to rapid economic development, the increasing formalization of jobs and a shift in the economy from agriculture to services. Additionally, households with annual incomes over Rs. 400,000 (US$5,000) are expected to experience a 5-8% Compound Annual Growth Rate (CAGR) between 2023 and 2028.

Growth of Organized Retail:

Due to increasing formalisation, the percentage of organized retail in India's total retail market has risen from 13-15% in 2018 to 18-20% in 2023. However, India still has significant room for growth compared to countries like the USA and China, where the share of organized retail in the overall retail market has reached 85-90% and 60-65% respectively. In the Indian retail sector, online retail has experienced the fastest growth, with its share increasing from approximately 3% in 2018 to 6-7% in 2023.

According to Redseer, Organized retail is expected to increase to 32-35% by 2028. As of 2023, the restaurant industry in India remains largely unorganized, with 70-75% of the 2-2.5 million restaurants being unorganized.

Online Food Service market: -

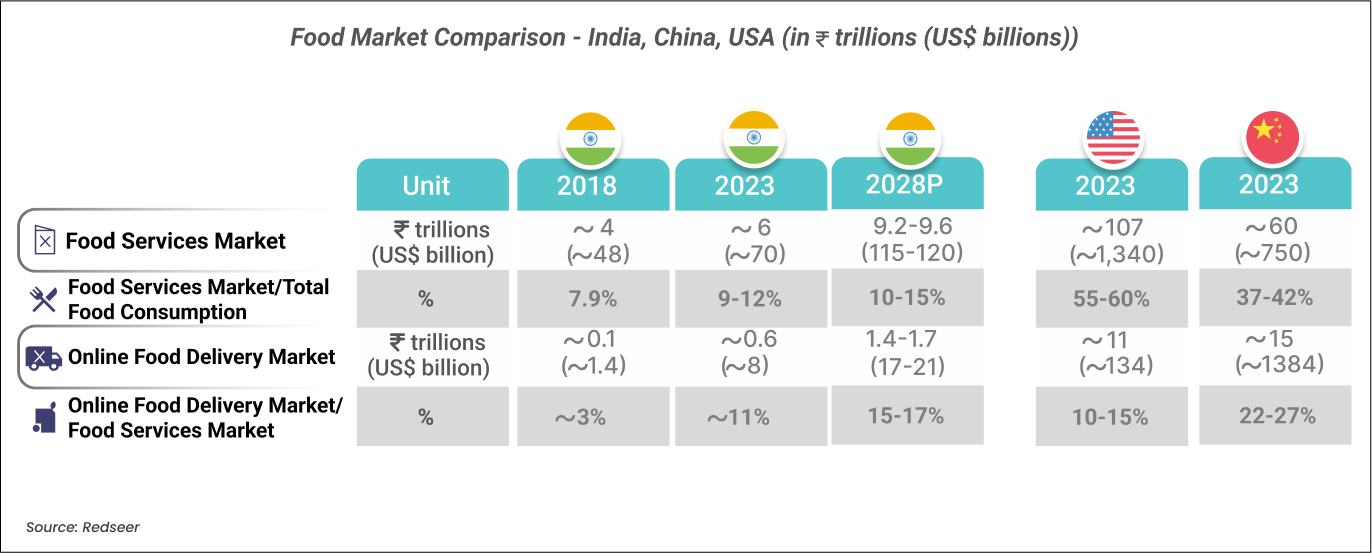

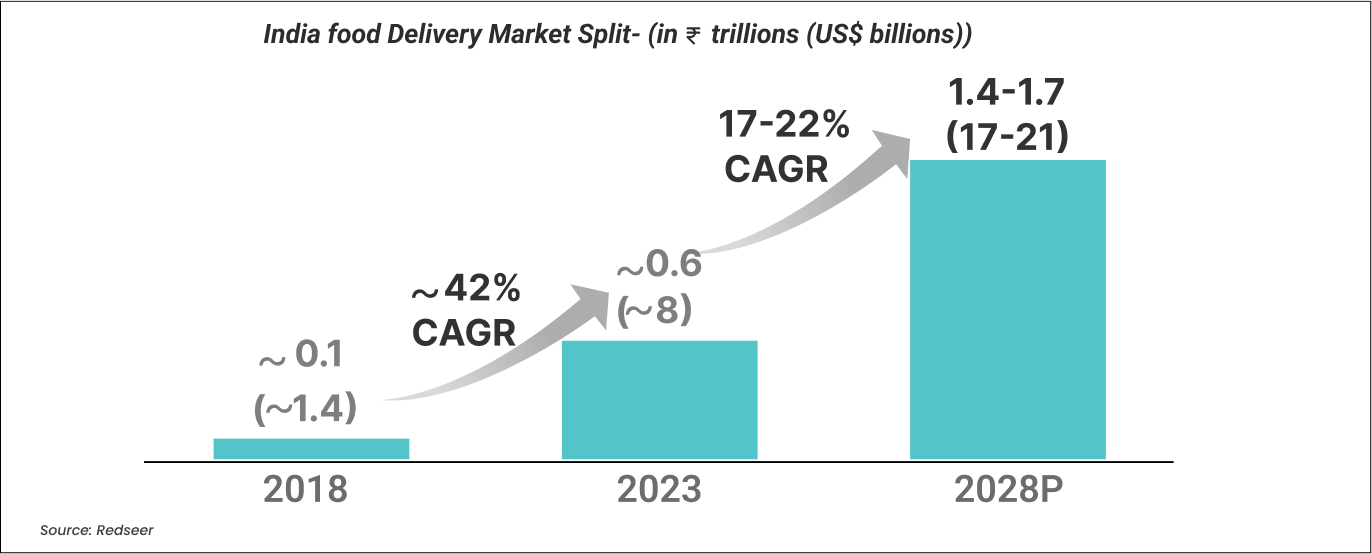

According to Redseer, the Indian food services market consisting of online food delivery and out-of-home consumption amounts to Rs. 5,600 billion (US$70 billion) as of 2023. The online food delivery market is the fastest-growing segment within the food services market and is projected to grow at a rate of 17-22% between 2023 and 2028. In the out-of-home consumption market, the organized segment and the online dining out segment are expected to grow at 15-18% and 46-53% respectively between 2023 and 2028.

As per Redseer, the online food delivery market in India grew from Rs. 112 billion (US$1.4 billion) in 2018 to Rs. 640 billion (US$8 billion) in 2023 and is expected to become Rs. 1400-1700 billion (US$17-21 billion) market by 2028, growing at a CAGR of 17-22.

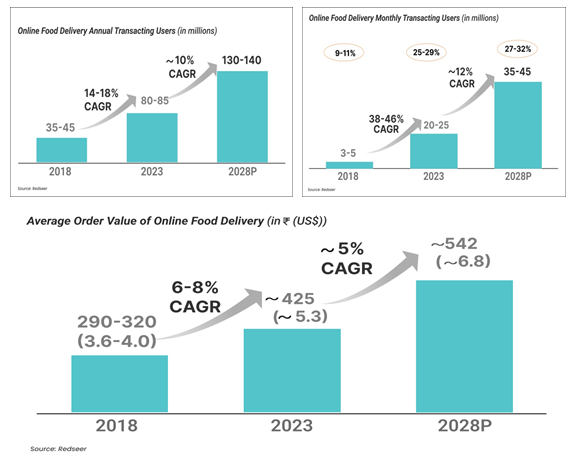

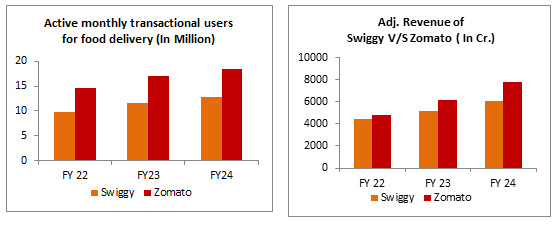

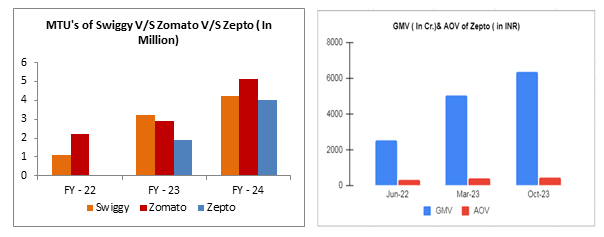

As per Redseer, the online food delivery annual transacting users are expected to grow at a pace of 10% CAGR till 2028 and the monthly transacting users are expected to grow with a 17% CAGR till 2028. The primary reasons for this increase are growth in internet penetration and convenience services. The average order value of food delivery is growing at a slow pace and expected a further slowdown from 8% CAGR in FY23 to 5% CAGR till FY28.

The Indian food delivery market is dominated by two main players: Zomato and Swiggy. According to Goldman Sachs, Zomato holds the larger market share at 57%, with Swiggy following behind at over 40%.

Quick Commerce Market: -

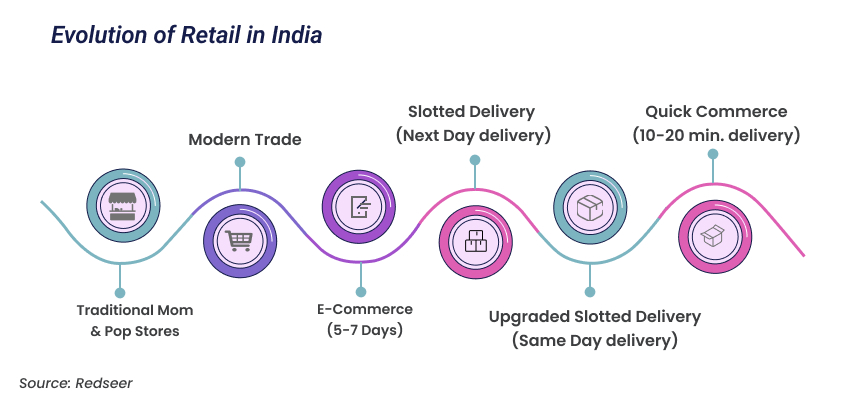

Catering to consumer demand for daily goods, groceries, vegetables, and fruits, quick commerce has the potential to revolutionize the retail market. It can be described as a class of e-commerce where products are delivered quickly to the doorstep of customers. The concept of instant deliveries has expanded from traditional ready-made meals to various items such as groceries, medicines, cosmetics, and electronics. It offers the speed of instant market purchases with the convenience of shopping from home.

There are many players in the Industry, namely Swiggy Instamart, Blinkit, Zepto & Big Basket Daily.

Businesses can choose to either adopt existing business models or create new ones to ensure fast and efficient delivery. Many of the quick commerce players utilize micro-fulfillment centres known as dark stores. These are small warehouses, typically ranging from 2,500 to 4,000 sq. ft and they stock around 6,000 unique products or SKUs (stock-keeping units). Dark stores are strategically situated close to customers to enable quick order fulfillment. However, the challenge lies in efficiently managing vehicle loads and coordinating delivery addresses due to the small volumes and frequent resupply, which must be completed within a short 15-minute timeframe. A typical dark store costs around 90 Lakhs to set up. As per JM Financial estimates, the total no. of SKUs per order ranges from 6-7 and the AOV (Average order value) ranges from Rs. 450- 500.

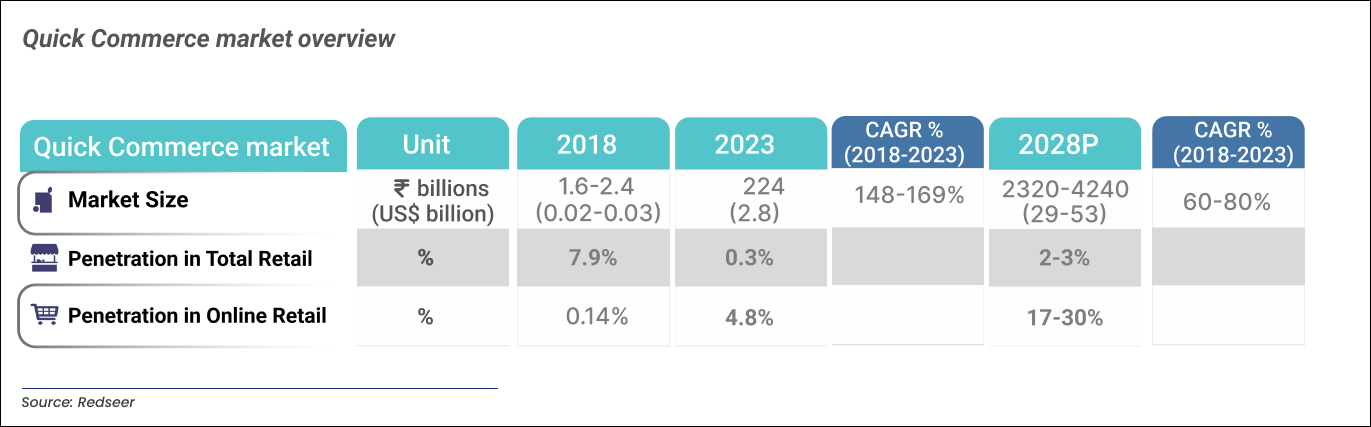

As per Redseer, the share of the quick commerce market in online retail has increased rapidly from approximately 0.14% in 2018 to 4.8% in 2023 and with the fast-paced growth of 60-80% expected annually till 2028, it is expected to reach 17-30% penetration in online retail resulting in a quick commerce market size of Rs. 2320-4240 billion (US$ 29-53 billion).

Business Segments:-

Food Delivery:-

The online food delivery business was started in 2014 and made a rapid expansion and achieved a market share of ~40% in FY24. As of today, the food delivery business operates in more than 681 cities giving them more headroom to grow as the no. of cities in India with a population of more than 50,000 stands at 1,000. The company connects restaurants and customers through the Swiggy app. In FY24 the company served more than 12.73 million active monthly transacting users. The customers are given an option to choose among more than 1.9 lakh restaurants. This connection with consumers is magnified by its efficient last-mile delivery through its large fleet of more than 3.9 Lakh delivery partners.

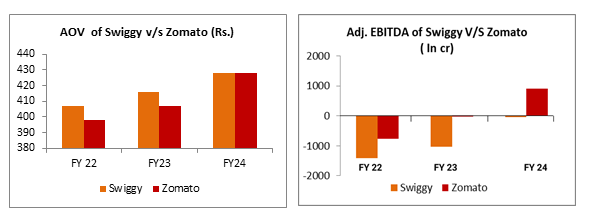

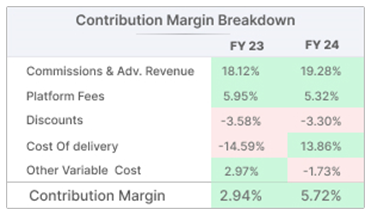

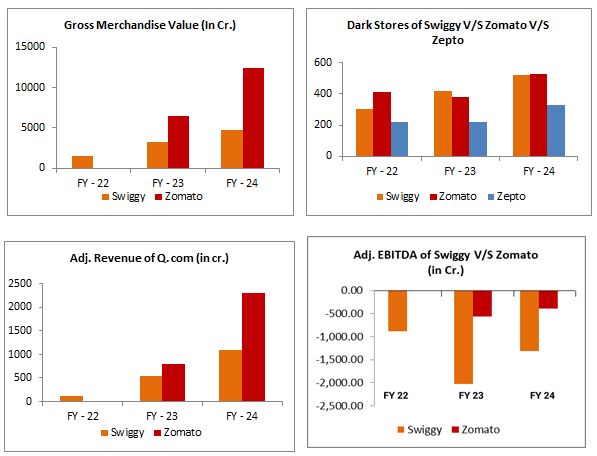

When we do a peer analysis, the number of active monthly transacting users, gross order value (GOV) and adjusted revenue are lower for Swiggy compared to Zomato. However, it's important to note that Swiggy's online food delivery segment has a negative adjusted EBITDA (Adj. EBITDA= EBITDA + lease adjustments). Swiggy excels in order frequency, which is higher than its peer, Zomato. Although Swiggy used to have a higher average order value (AOV), its peer Zomato has successfully scaled up.

The primary source of revenue for the food delivery business is the intake rate (calculated as % of revenue to GMV or GOV) charged to partner restaurants, which falls between 23% and 25%. However, a significant portion of this revenue is used to cover the delivery cost which is difficult to pass on to customers completely and this results in very thin contribution margins ((Revenue-Variable cost)/Revenue). Nevertheless, the Swiggy One subscription has the potential to drive future revenue. The company introduced the Swiggy One subscription for just Rs. 9, offering the primary advantage of free delivery within a 7 km radius of the user's address. While it may not have a significant impact on revenue, it has increased the GOV as users order food frequently due to the free delivery benefit.

Contribution margin = Revenue as a % of GOV

Supply Chain & Distribution:

This is the second largest revenue stream for the company contributing Rs. 4,779 cr. The company offers comprehensive supply chain services to wholesalers and retailers. By leveraging its warehousing capabilities, the company streamlines the value chain to provide reliable, fast, and cost-effective order fulfillment for wholesalers and retailers. The company's supply chain solutions to its wholesale and retail partners encompass warehouse management to streamline operations, in-warehouse processing that includes value-added services to enhance product delivery, and efficient order fulfillment which enables efficient order picking, packing, and shipping processes for the wholesalers and retailers.

Quick Commerce (Instamart): -

The company launched Instamart in 2020 to offer on-demand grocery and a wide range of household items to users. On Instamart, users can access and browse a large selection of grocery and household items. These orders are received by merchant partners, processed through the company’s Dark Stores, and delivered to users through delivery partners. In June 2024, orders were typically delivered in an average time of approximately 12.6 minutes. The company’s platform currently lists a selection of over 19,000 SKUs within grocery and household items. These products include:

- Utility-driven, daily purchases such as eggs, bread, fruits and vegetables

- Impulse purchases of snacks and quick-eats

- Recurring purchases made typically on a monthly or weekly basis, such as home supplies, including shampoo, soap, among others

- Need-driven purchases made on an ad-hoc basis, such as feminine hygiene, basic pharmaceutical and personal care items and stationery

- Events and festivities-related purchases that include sweets, festival supplies and team merchandise during sports events.

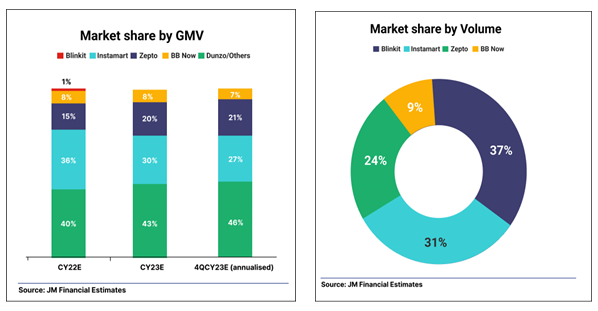

Swiggy is the second largest player in the Quick Commerce Industry by volume and Gross Merchandise Value (GMV). The company integrated the Instamart division into the existing Swiggy app. Unlike its food delivery business, this division is an oligopoly market with 3 firms controlling around 90% of the market share.

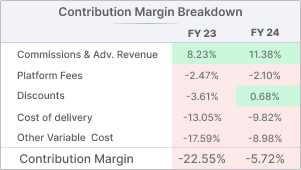

The segment’s contribution margins are improving, but they are still negative as the company is focusing on improving GMV and attracting customers. The improvement in the other variable cost can be attributed to the company’s efficient cost-cutting through the use of automated processes.

Contribution margin = Revenue as a % of GOV

The company’s intake rate is lower at 14% compared to Zomato's 18%. Although the AOV (Average order value) is similar, Swiggy has a higher monthly order frequency on its quick commerce platform compared to Zomato. Zomato outperforms Swiggy in terms of monthly transacting users and gross merchandise value. Furthermore, Zomato has higher adjusted revenue and a lower negative adjusted EBITDA compared to Swiggy.

The expansion pace of Swiggy's dark stores is slower compared to its competitors. For example, Zomato plans to expand its dark store network from the current 500 stores to 2000 within 2 years, while Swiggy's second largest competitor Zepto plans to expand from 350 to 700 dark stores by March 2025 with an investment of $665 million. Swiggy’s plans to double the current 500-odd dark stores will take more than 3 years.

Swiggy's Quick Commerce division operates in 32 cities compared to Zomato's 26 cities, indicating a clear intent to expand its gross merchandise value through its existing dark stores rather than outright expansion.

Objectives of the offer:

Advantages:

- High growth industry: Indian consumer preferences are changing from cost conscious to convenience driven. The convenience driven products which primarily include unplanned and immediate purchases account for more than 50% of the e-commerce sales volume. Due to the inefficient practices of unorganized retail Kirana stores, the quick commerce industry can offer services at competitive rates while also being consistent & efficient.

- Better unit economics: Operating a dark store is more efficient than a supermarket due to its smaller footprint, as it typically needs about 50% less space. Unlike supermarkets, dark stores don't rely on prime locations to attract customers, resulting in lower operational costs. A typical dark store can reach a positive contribution margin within 3-6 months, which helps improve the company's overall performance as these stores mature. The company’s path to profitability can be accelerated with active vendor engagement, expanding the portfolio and introducing higher priced products.

- High innovation and organic growth: The Company has developed in-house services, like its Swiggy Instamart, demonstrating an innovative culture in the organisation. Unlike Zomato, the company is focused on its core areas and is not venturing into unrelated fields.

- Higher loyal customers: Although the company is not a market leader in terms of revenue, GMV, or adj. EBITDA, it excels in the frequency of orders by its users in both the quick commerce and food delivery segments showing its high quality service delivery.

Concerns & Challenges:

- Equity dilution via ESOPs: Swiggy’s founder Sriharsha Majety was allocated Rs. 1820 Cr. worth of ESOPs which increased his stake in the company by 2%. Additionally, key managerial personnel of the company also received ESOPs. The combined ESOPs pool is estimated to be worth ~ Rs. 3200 Cr. Even Zomato’s Founder Deepinder Goyal was allotted ESOPs worth Rs. 2800 Cr before the IPO. ESOPs of such high quantum can further dilute the ownership of other shareholders of the company.

- Exit of key managerial personnel: The Attrition of key managerial personnel is high in this industry. Although the departure of key managerial personnel may be because of variable reasons, the high attrition of experienced personnel who shaped the company can be a serious concern.

- High CAC (Cost of acquisition of customer): Currently, quick commerce is a phenomenon in Tier 1 cities. When platforms aggressively start entering lower-tier cities, they may end up making significant spending on customer acquisition and retention. Additionally, they may also end up subsidizing last-mile delivery/packaging costs, all of these measured will increase their cost of acquisition.

- Dark store churn: Selecting the ideal dark store location can be a complex activity, as there are multiple variables such as lower demand, different customer preferences which can go wrong, this in turn can lead to high churn rates, if not handled well.

Management Snapshot:-

Sriharsha Majety: - He is the Co-founder & CEO of the company. He holds a bachelor’s degree in engineering in electrical and electronics engineering from BITS, Pilani and Has a PGDM in management from IIM, Calcutta. He has more than 10 years of experience in the company.

Lakshmi Nandan Reddy Obul: - He is the Co-founder & Director of the company. He holds an MSc. Physics from BITS, Pilani. He has more than 10 years of experience in the company.

Phani Kishan Addepalli: - He is the Co-founder and the head of Swiggy Instamart. He completed a B. Tech in Computer Science and Engineering from IIT Madras and PGDM from IIM Kolkata.

Conclusion:

Swiggy is well-positioned in both the online food delivery and quick commerce sectors, offering high-quality products and services with impressive operational efficiency. Although competition in quick commerce is intensifying, we believe that new entrants face significant challenges due to the effective execution by established players like Swiggy, Zomato and Zepto.

Swiggy’s convenience offering is reflected in its high order frequency, which is expected to increase as the company continues to scale, leading to potential gains in order frequency and average order value (AOV), ultimately improving intake and contribution margins.

India's retail landscape remains largely unorganized and inefficient, offering substantial growth potential for organized players, particularly in quick commerce, where services are still nascent. Swiggy has demonstrated its strength in both category creation and execution, setting a strong foundation for continued growth.

With an IPO price band of Rs. 371-390 per share, Swiggy seeks a valuation of approximately Rs. 87,299 Cr, equating to about 8x sales. While relatively more affordable than Zomato, which trades at a significantly higher ~18x sales, Zomato's clear path to profitability already achieved in food delivery places it in a different financial position. Swiggy, however, still has a way to go before reaching profitability. Given the valuation, Swiggy's dynamic business model, and the prospect of intense cash burn over the next 2-3 years to maintain market share amid growing competition, generating meaningful returns from this investment may prove challenging.

Recommend AVOID

Swiggy Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | November 6, 2024 |

| IPO Close Date | November 8, 2024 |

| Basis of Allotment Date | November 11, 2024 |

| Refunds Initiation | November 12, 2024 |

| A credit of Shares to Demat Account | November 12, 2024 |

| IPO Listing Date | November 13, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 38 | Rs. 14,820 |

| Maximum | 13 | 494 | Rs. 192,660 |

Swiggy Limited IPO FAQs:

When will the Swiggy Ltd IPO open?

Swiggy IPO will open for subscription on Wednesday, November 6, 2024 and closes on Friday, November 8, 2024.

What is the price band of Swiggy Ltd IPO?

The price band for Swiggy Ltd IPO is Rs. 371-390/share.

What is the lot size for the Swiggy Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 38 shares, up to a maximum of 13 lots i.e. Rs. 1,92,660/-.

What is the issue size of the Swiggy Ltd IPO?

The total issue size is ~ Rs. 11,327.43 Cr.

When will the basis of allotment be out?

Allotment will be finalized on November 11th and refunds will be initiated by November 12th. Shares allotment will be credited in Demat accounts by November 12th.

What is the listing date of Swiggy Ltd.'s IPO?

The tentative listing date of the Swiggy IPO is November 23rd, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: